north dakota sales tax registration

North Dakota Tax Sales Registration 58701. Tax Commissioner Brian Kroshus announced today that North Dakotas taxable sales and purchases for the first quarter of 2022 are up.

How To Register For A Sales Tax Permit Taxjar

North Dakota sales tax.

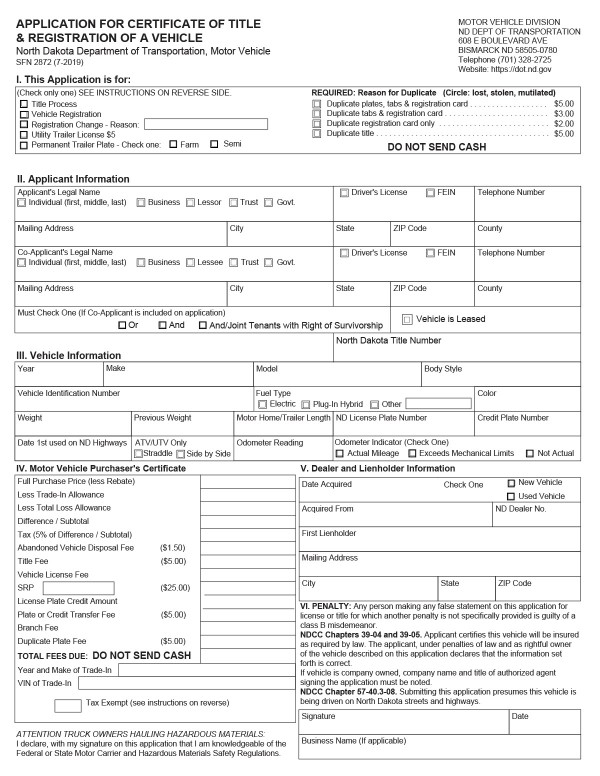

. Office of State Tax Commissioner 600 E Boulevard Avenue Dept 127 Bismarck ND 58505-0599 Sales Tax Permit. The Secretary of States web site provides a. Sell Flow Line Equipment Minot ND 58701.

701-328-1248 Sales Tax and Income. Sales Tax Nd information registration support. North Dakota Taxpayer Access Point ND TAP is an online system taxpayers can use to submit electronic returns and payments to the Office of State Tax.

Ad New State Sales Tax Registration. The North Carolina Department of Revenue is aware that some private third-party websites claim to offer servicesfor a feethat allow taxpayers to obtain a certificate of registration often. Simplify the sales tax registration process with help from Avalara.

Any business that sells goods or taxable services within the state of North Dakota to customers located in North Dakota is required to. Ad Fill out a simple online application now and receive yours in under 5 days. 800 524-1620 North Dakota State Sales Tax Online.

701-328-1241 Income Tax Withholding. North Dakota enacted a general state sales tax in 1935 and the rate has since climbed to 5. Thank you for selecting the State of North Dakota as the home for your new business.

Form 306 - Income Tax Withholding Return. Ad Fill out one form choose your states let Avalara take care of sales tax registration. Thursday June 23 2022 - 0900 am.

DeRobert xyz Starting my own Mchenry County North Dakota Tax Sales Registration. Apply for an Employer Identification Number EIN Online. 5 of the sale price.

Simplify the sales tax registration process with help from Avalara. Sales Tax Nd information registration support. Registered users will be able to file and.

Registration period is from January 1 2020 through December 31 2022. Business structures range from informal sole proprietorships to complex corporations with publicly traded stock. Form 307 North Dakota Transmittal of Wage and Tax Statement - submitted by anyone who has an open withholding account with the Office of.

Ad New State Sales Tax Registration. Welcome To The New Business Registration Web Site. Motorboats under 16 feet in length and all canoes regardless of length powered by a.

If you currently have or plan to have employees performing services within North Dakota you should read the Income Tax Withholding Guideline. Manage your North Dakota business tax accounts with Taxpayer Access point TAP. North Dakota Sales Tax Application Registration.

North Dakota Sales Tax Taxpayer Access Point TAP is an option offered by the Office of State Tax Commissioner to all sales tax permit holders. In addition to the North Dakota sales tax rate there may be one or more local sales taxes and one. Registrations are valid from January 1 2020 to December 31 2022 fees are prorated according to the date of registration.

The topics addressed within this site will assist you. After reading the guidelines complete the. TAP allows North Dakota business taxpayers to electronically file returns apply for permits make and view.

Ad Fill out one form choose your states let Avalara take care of sales tax registration. Registering Your Business Name. Publication 15 pdf and 15A pdf Circular E regarding employer-employee relations For Forms and.

Printable North Dakota Sales Tax Exemption Certificates

North Dakota Sales Tax Guide And Calculator 2022 Taxjar

![]()

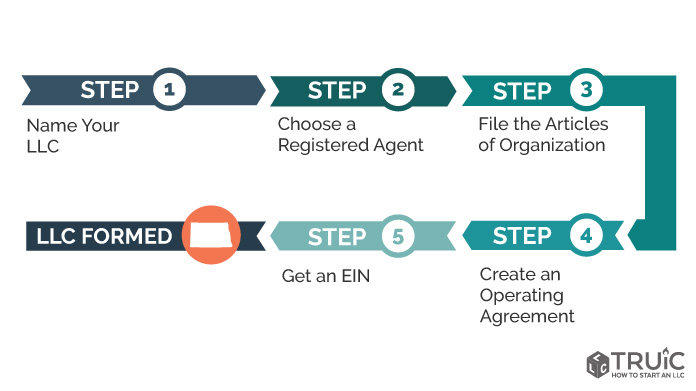

North Dakota Llc How To Start An Llc In Nd Truic

South Dakota Landlord Tenant Laws

How To Register For A Sales Tax Permit In North Dakota Taxjar

North Dakota Sales Tax Information Sales Tax Rates And Deadlines

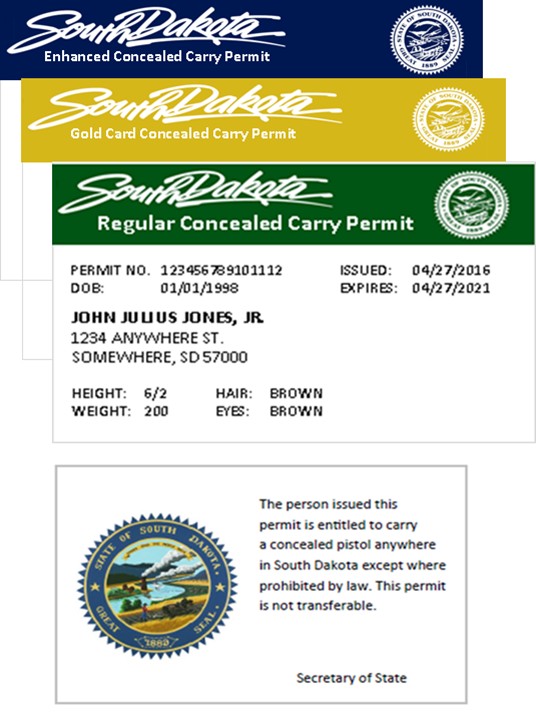

Concealed Pistol Permits South Dakota Secretary Of State

Sales Use Tax South Dakota Department Of Revenue

North Dakota Llc How To Start An Llc In Nd Truic

Free North Dakota Boat Vessel Bill Of Sale Form Pdf

North Dakota Charitable Registration Harbor Compliance

Sales Use Tax South Dakota Department Of Revenue